Tax Debt Relief - Questions

Table of ContentsThe Best Strategy To Use For Tax Debt ReliefGetting The Tax Debt Relief To WorkThe smart Trick of Tax Debt Relief That Nobody is Talking AboutTax Debt Relief Fundamentals ExplainedThe 5-Minute Rule for Tax Debt ReliefTax Debt Relief Things To Know Before You Get This

Take a look at what every taxpayer requires to know regarding the IRS financial obligation forgiveness program. What Is the IRS Debt Mercy Program? The IRS offers a number of alleviation options for taxpayers who owe overdue taxes.Remember the internal revenue service will rule out you for any kind of tax obligation alleviation benefits unless every one of your tax obligation returns from present and also previous years have been submitted. The internal revenue service won't hold the reality that you have actually filed returns late against you when examining your qualification, so if you have unfiled tax returns, getting existing is the primary step to being given financial obligation forgiveness. It's crucial to keep in mind that both of these choices require you to divulge financial info to the IRS. The last point you desire to do is existing info that negates your claim that you're incapable to pay your tax obligation costs.

Call now to begin the process of freezing penalties and also obtaining debt eliminated.

Rumored Buzz on Tax Debt Relief

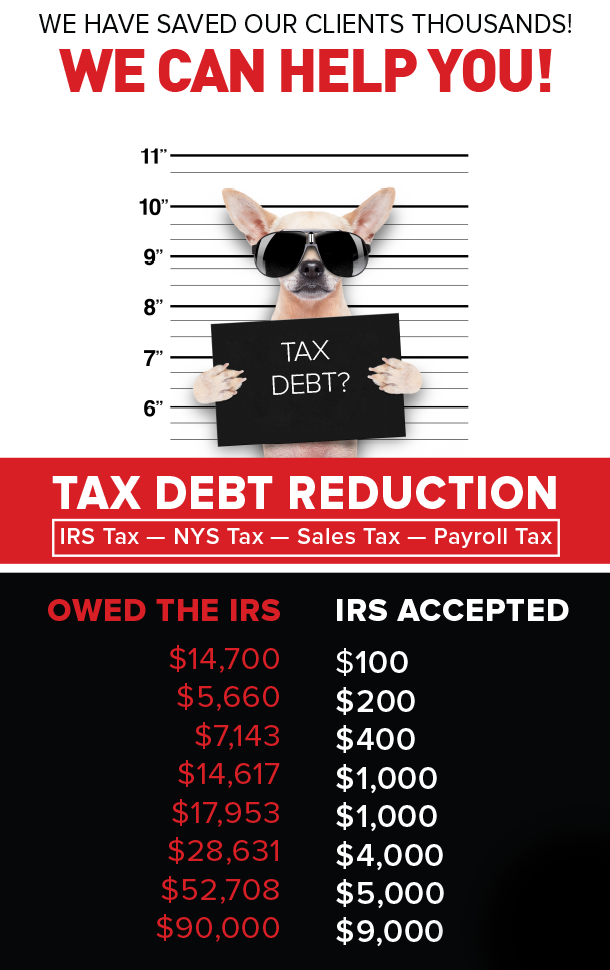

There may be a couple of attorneys and a handful of individuals in the firm who did work for the IRS at some point, the bulk of staff members possibly have not. What Tax Negotiation Firms Deal The majority of tax obligation settlement firms promise to send their experts to the Internal revenue service to negotiate on part of the client, where they can most likely convince the company to accept a much smaller sized amountoften dimes on the buck.

This is a special arrangement that some taxpayers can make with the Internal revenue service to resolve their tax financial debts for a minimal amount than what is owed.

Getting My Tax Debt Relief To Work

The variety of offer-in-compromise applications that are in fact accepted is generally extremely reduced. To have such a reduction authorized, taxpayers should show that the overall quantity owed is inaccurate, the possibility of being able to repay the full amount is very low, or paying back the total will certainly lead to remarkable monetary hardship.

This is generally the quantity of cash the business says it will certainly save the client in tax payments. Clients have actually whined to the Bbb (BBB) and also the Federal Profession Compensation (FTC) that some of these companies have actually not created any of the assured results as well as, as a matter of fact, the company was a fraud.

Any type More hints of respectable tax relief company will certainly first get key economic information from its customers before providing a realistic analysis of what they can do for an affordable fixed cost. Potential customers would certainly be smart to locate a neighborhood firm that has actually been in organization for a number of years and has a visibility in the neighborhood.

More About Tax Debt Relief

The Internal revenue service previously issued warnings to the public about fraudulent companies, pointing out several of the issues detailed below.

Unethical business might accumulate hundreds or countless bucks in charges without giving the outcome you seek. On the other hand, great business charge reasonable, transparent fees as well as have actually confirmed track documents. Some firms charge a level portion of the amount owed to the IRS, such as 10%. Others bill a per hour price that may range between $275 as well as $1,000.

While lots of taxpayers get refunds at click resources tax obligation time, losing is not uncommon. In current years, roughly 20% of taxpayers one in 5 data a return with a debt of regarding $3,000. (Recommendation: Submit your tax obligations! Even if you're not able to come up with the payment; after that get in touch with the agency regarding obtaining out of federal hock.)Luckily, because what the internal revenue service (and also any type of various other tax-enforcement company) really desires is what the government is owed, there are ways out of tax-debt trouble.

The 6-Second Trick For Tax Debt Relief

Which one is right for the tax-debtor depend upon his/her general economic condition. Who might require tax-debt relief? Taxpayers who have dropped behind and also lack the resources to pay their financial debt through individual financing, house equity financing, debt card, investments, and so on. Taxpayers in financial obligations that have come to the interest of personal debt collection agencies worked with by the other IRS.Those that have stopped working to file income tax return for any type of number of years, however who have (until now) took care of to operate beneath the radar of the IRS.Taxpayers whose financial obligation is so "seriously delinquent" ($50,000 or more) the internal revenue service has actually instructed the State Division to refute, withdraw or take their tickets.

Any of the programs can be self-initiated by the taxpayer. For those unwilling to go it alone, a tax-settlement industry has arised to aid consumers browse the firm's regulations. In ads, a few of the players assert remarkable qualifications, experience, as well as amazing outcomes. Look out (Tax Debt Relief). While the majority of tax obligation settlement solutions promote rosters of previous internal revenue service agents and various other tax obligation professionals all set to use their expertise to reduce what you owe, the fact is something various.

The Ultimate Guide To Tax Debt Relief

The internal revenue service considers a host of elements, amongst them capacity to pay, income, costs, and also asset equity. The agency typically accepts an offer in compromise only when the amount offered represents the most it can expect to accumulate in a reasonable period of time. Applications need to be accompanied by a payment of 20% of the total offer amount, plus a nonrefundable $186 fee.